I'm trading pinbars and PA bars less and less these days. Not because there's anything wrong with them but I'm moving more towards supply/demand trading. Anyway, here is a joke of a pinbar trade I took. Here's the entry chart explaining my reasons to short. Click chart to enlarge. Risk was 1%.

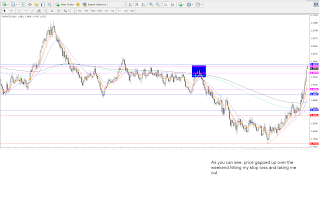

and here is the exit chart showing the pinbar failing. One thing you don't do is sell into support or buy into resistance, and that's exactly what I did. I sold into support. I don't know why I missed those bar highs before placing the order. Not only that, but once I was triggered short I done realised my mistake and even had a chance to cut the trade for a small profit/break even. Like an idiot I decided to leave it alone and deservedly got taken out for a full loss.

Analysis: Not much more I can add to what I've already said about this trade. Shouldn't have shorted it, my entry was okay because at least I entered on a retrace, but trade management was a big fuck up 'cause I KNEW I had made a mistake, the market gave me a life line to exit the trade at break even or even a small profit and I STILL held on because I was greedy and ended up paying for it. The only good thing about this is that I can see where I went wrong. Whenever I lose a trade I always like it when I can see something obvious that I did wrong. This way I have something to improve on, and therefore better my performance. I'd much rather that than to lose a trade and not see anything wrong with the setup in hindsight. That shit happens though, sometimes even a great setup can fail, but this was anything but a great setup.