So January started off really well and then it went downhill but I still ended the month with a modest profit. February was just a bad month full stop. I lost all I had made in January plus a little more. In February I took 19 trades, of which 15 were losses and there were two wins at 3:1 RR, one win at 2:1 RR and one win at 0.5:1 RR.

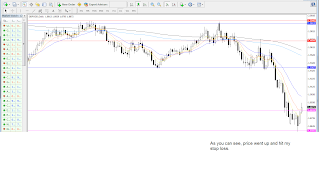

Not great but my account hasn't taken too much damage from the start of the year and like I've said time and time again, trading performance should be judged over a long period. 12 months ideally, but at least 6. I've stuck to my plan, made a mistake here and there which I've learned from, and I'm very confident this is gonna be a good trading year. Back testing continues to give me great results and in a way is consistent with my real life results (I have had 8 losses in a row at times in back testing but even then all the pairs I tested made great profit in the long run). Luckily I do have a few other income streams that bring in modest returns so I've been able to have somewhat of a life, but I'm still living like a clown for the moment. Not worried though. Just focused on my dream of becoming a world class, pound for pound all time great trader. I'll have my time, no doubt about that. I'm in profit for the month of March so far, and the charts of the two trades I've taken this month will be up soon.

When I've been back testing I've been using a method that is not totally, but mostly mechanical and requires very little discretion. On all the pairs I've tested I've got a win rate between and 35-45%, but when I modified it to use more discretion (only done this for one pair so far) I got a win rate of 60%. In the long run although the win rate was higher, the overall profit was smaller, BUT here's the thing. There were less trades to take (less work), and less draw down. I think I'm willing to sacrifice a bit of profit if it reduces stress for the time being. Therefore I'm gonna use much more discretion when back testing, and then if I continue to get good results I'll apply it to live trading.

That's the plan for this month. Have a great trading month.